-40%

Berkshire Fine Spinning Associates, Inc. (Berkshire Hathaway) Stock Certificate

$ 13.2

- Description

- Size Guide

Description

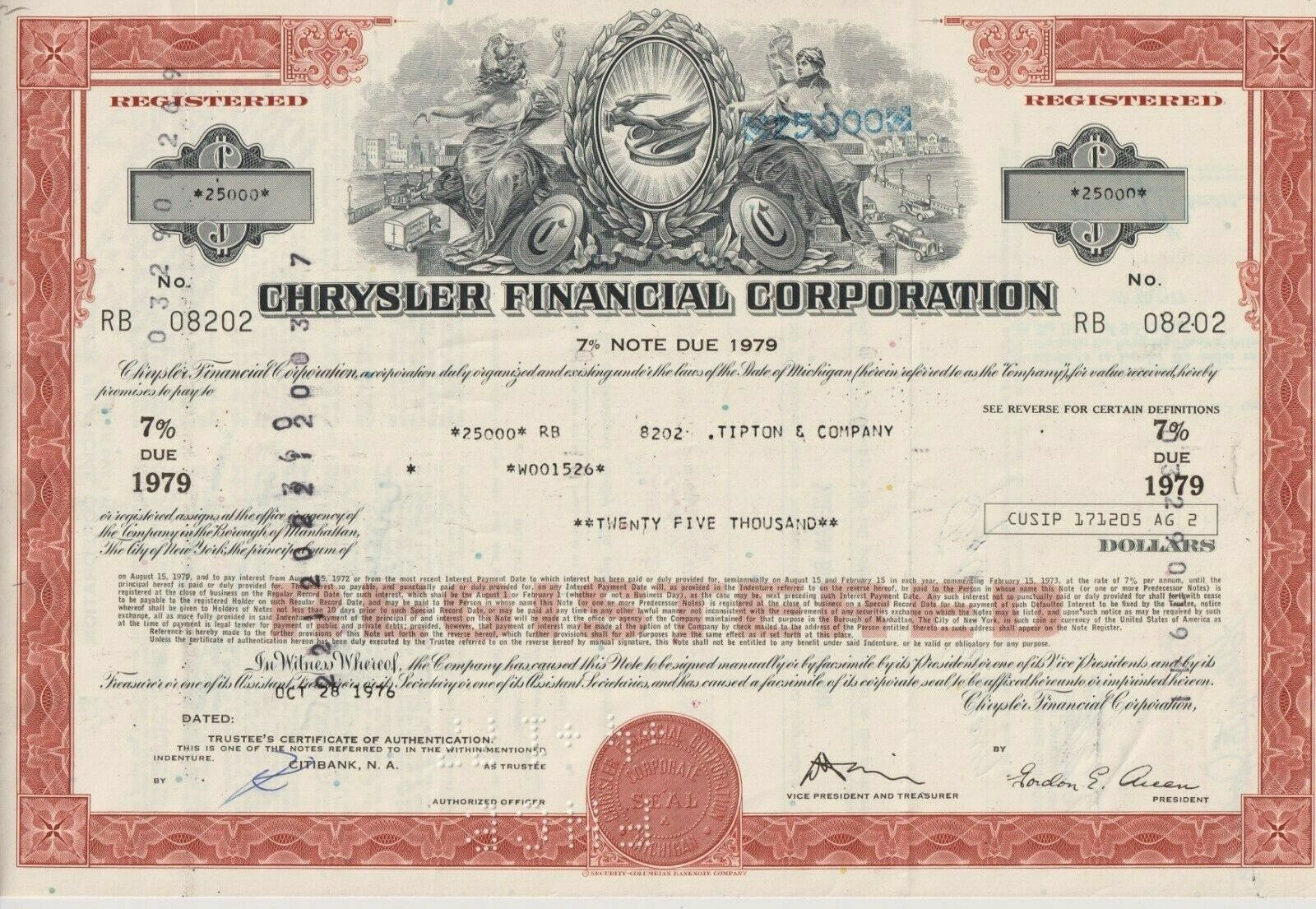

Product DetailsNicely engraved antique stock certificate from Berkshire Fine Spinning Associates, Inc. dating back to the 1940's. This document, which has been signed by the company Vice President and Assistant Treasurer, was printed by the American Bank Note Company, and measures approximately 11 3/4" (w) by 7 3/4" (h).

Images

You will receive the exact certificate pictured.

Historical Context

Berkshire Fine Spinning Associates was founded in 1889 as Berkshire Cotton Manufacturing Company in Adams, Massachusetts. The first mill built by the company was Berkshire Mill No. 1 in Adams. By 1917 the company was capitalized at ,500,000 and contained over 260,000 ring and mule spindles and 6,500 looms for the production of cotton textiles, making it one of the largest cotton textile companies in the world. In 1929, Berkshire merged with the Valley Falls Company of Rhode Island, and became known as Berkshire Fine Spinning Associates. Its head was Malcolm Greene Chace of the influential Chace family of New England. Malcolm's descendants (his son Malcolm Jr, and grandson Malcolm III) would run the company until 2007.

In 1930 the company acquired the King Philip Mills in Fall River, Massachusetts. In 1931 the company acquired the Parker Mills of Fall River and Warren, Rhode Island.

Unlike many New England textile companies that failed during the 1920s and 1930s, Berkshire Fine Spinning Associates would survive the Great Depression intact. At its peak in 1948, Berkshire earned .5 million and employed 11,000 workers at 11 mills, under the leadership of Malcolm Greene Chace, Jr.

In 1955, Malcolm Jr. put together the merger of Berkshire with Hathaway Manufacturing Co., founded in New Bedford, Massachusetts in 1888 by Horatio Hathaway, to form Berkshire Hathaway Inc.

By the 1960s, the Berkshire mill empire had declined to seven plants and 6,000 people, but still annually produced one quarter of a billion yards of material that sold for more than million. The assets, and a sizable amount of cash on the balance sheet, caught the eye of Warren Buffett, an up-and-coming but little-known investor from Omaha, Nebraska.

Buffett, who had founded Buffett Partnership Limited to make investments, started buying stock in Berkshire at .60 a share. He eventually paid an average of .86 a share, or a total of million, and took control of the company on May 10, 1965.

By then, the company had declined to two mills and 2,300 employees. Buffett used Berkshire Hathaway as his investment vehicle, took the chairman's job in 1970 and acquired dozens of companies.